| Date begun | April 15, 2008 |

|---|---|

| Date terminates | December 31, 2030 (at the latest) |

| Pro Peak Oil | Don Geddis |

| Con Peak Oil | Winfred Ark |

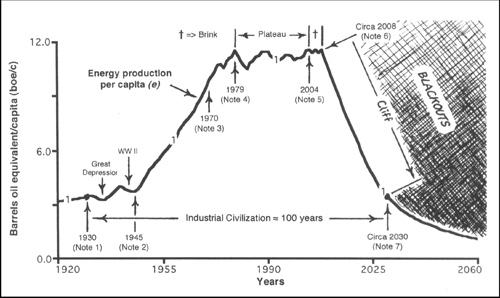

The theory of Peak Oil suggests that mankind will reach a maximum annual production capacity at some point, sooner rather than later. Production from conventional oil fields is known to have a steep falloff in output after reaching peak production. In 1956, Hubbert described his theory of how oil production of a given oil field would follow a bell shaped curve. As predicted, US domestic oil production indeed did peak in 1970. (The OPEC oil shock of 1973 was not a coincidence in timing.)

To be fair, Win doesn't dispute the overall theory of Peak Oil, but he also doesn't believe that we're in it right now. And he's far more optimistic than me about the possibilities for large-scale production of non-conventional sources, to make up for the coming decline in existing conventional oil field production.

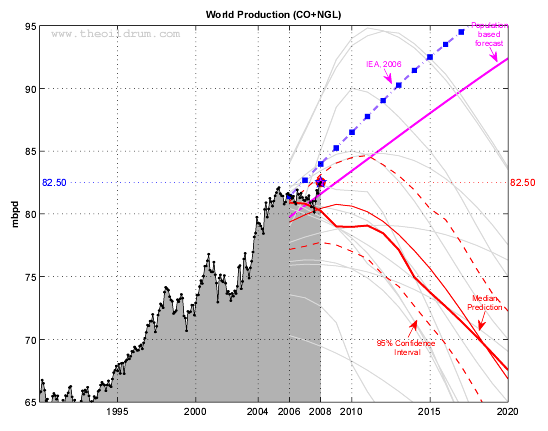

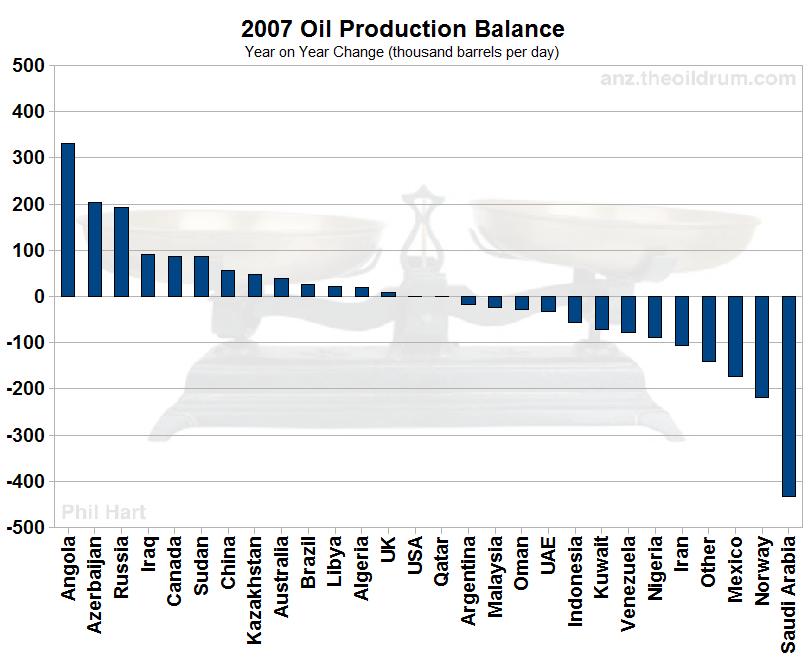

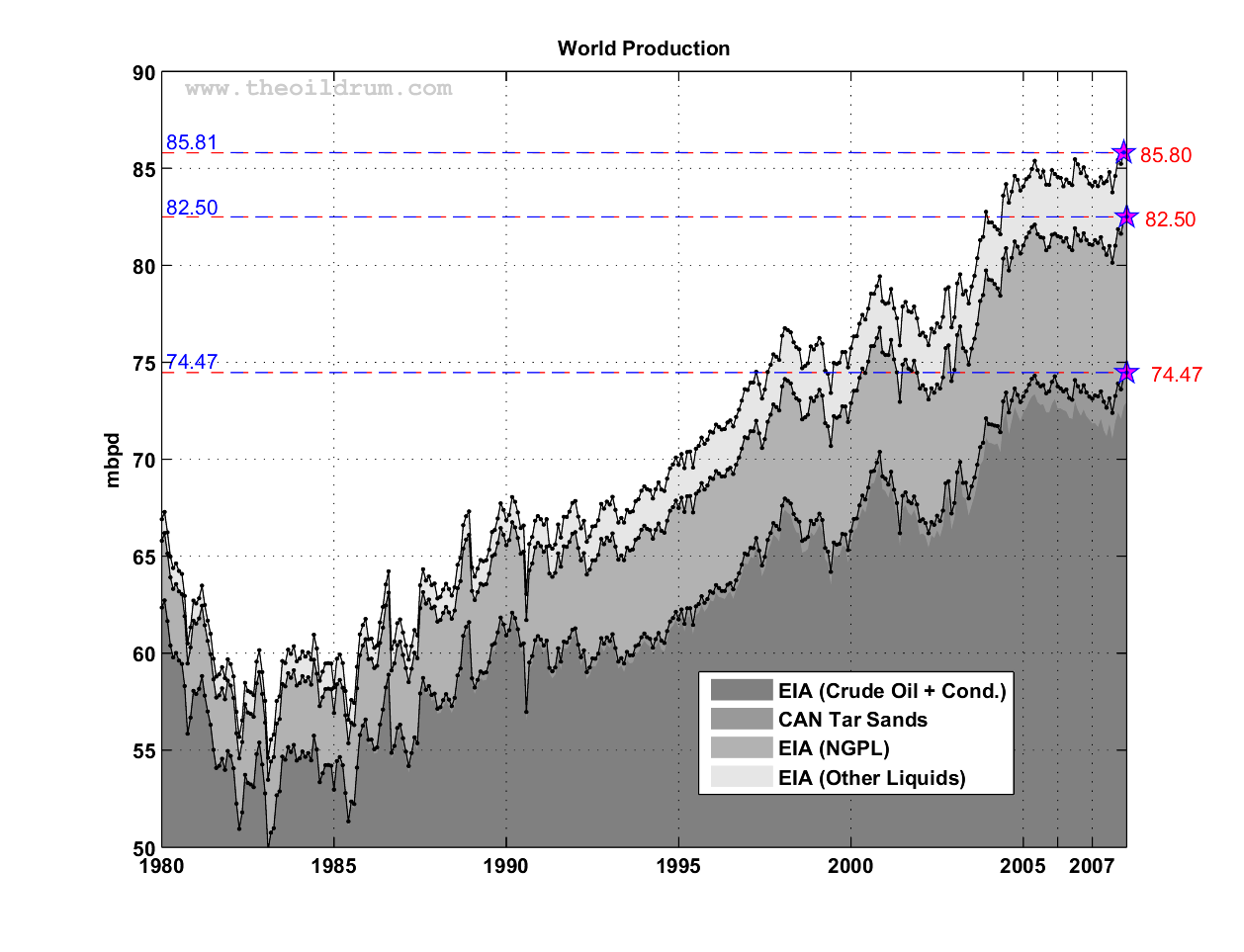

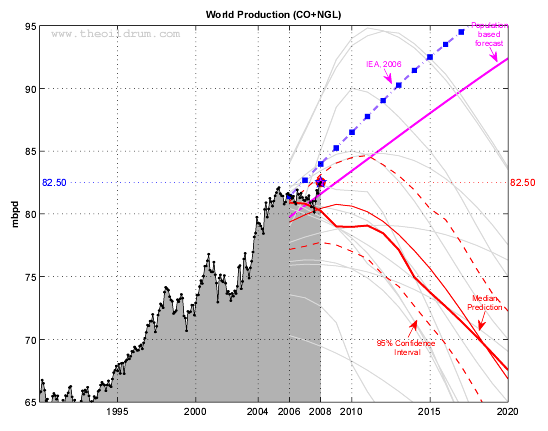

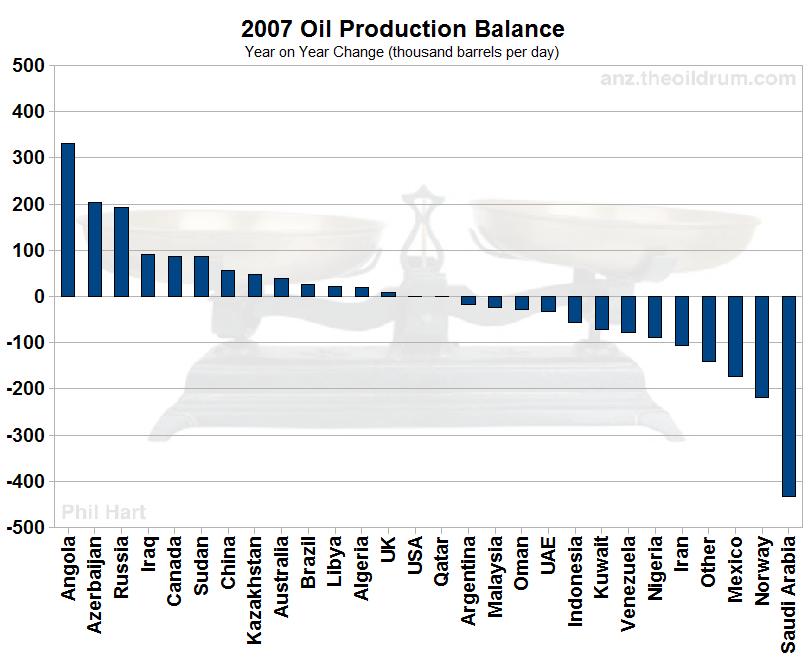

Through 2006 (according to EIA/DOE), the maximum world crude oil production was in 2005, at an average daily rate of 73.65 million barrels per day. Don believes that we're currently in what will be historically seen as an extended plateau of peak oil. Minor world events (political upheavals, natural disasters) might shift the actual annual production up and down a bit for the next few years, but it will never rise significantly above the current levels, and within 5-10 years will begin an irreversible decline.

Win believes that numerous temporary factors (Iraq war, hurricane Katrina) are holding down current production, and that new sources (oil shale, tar sands, North Dakota find) will come online to boost production in the future, and that current high US prices are somewhat caused by a temporary weak US dollar in the currency markets.

Don's view is that non-conventional sources can't possibly make up for the magnitude of the coming decline in conventional oil production. Meanwhile, "new discoveries" have lagged demand and production growth for decades (see graph at right). It is already too late for new oil to fill the coming decline of existing, proven fields.

Note that this is purely a supply-side argument. The price of a barrel of oil will be set by the intersection of supply and demand. According to peak oil, supply will fall, regardless of price. As world demand has been growing a couple percent a year for 50-100 years, this implies skyrocketing oil prices (in order to force demand lower) in the near future. It is already the case that oil was less than $25/barrel in 2001, and is currently (in April 2008) more than $110/barrel. Yet Peak Oil hasn't even arrived, and China and India (with huge potential demand) are just now coming "online" in terms of their national oil use.

The Bet: Between 2008 and the year 2030, if the world's annual production of crude oil ever meets or exceeds an average of 75 mbpd, then Win Ark wins. If the annual crude oil production between 2008-2030 is always less than 75 mbpd average, then Don wins. Stakes: the monetary equivalent of the closing price of a barrel of US West Texas Intermediate crude oil at the end of the year when the bet terminates.

Note: we're using the official statistics from the Energy Information Administration (EIA), a division of the US Department of Energy (DOE). A copy of the chart as of the date this bet was arranged (4/15/2008), listing world crude oil production, 1960-2000, has been saved for posterity. Termination conditions for this bet will need to be counted using the same methodology as expressed in that chart. Namely: average daily world production, across an entire year, of "crude oil plus condensate", but not including natural gas or other components of "all (hydrocarbon) liquids".

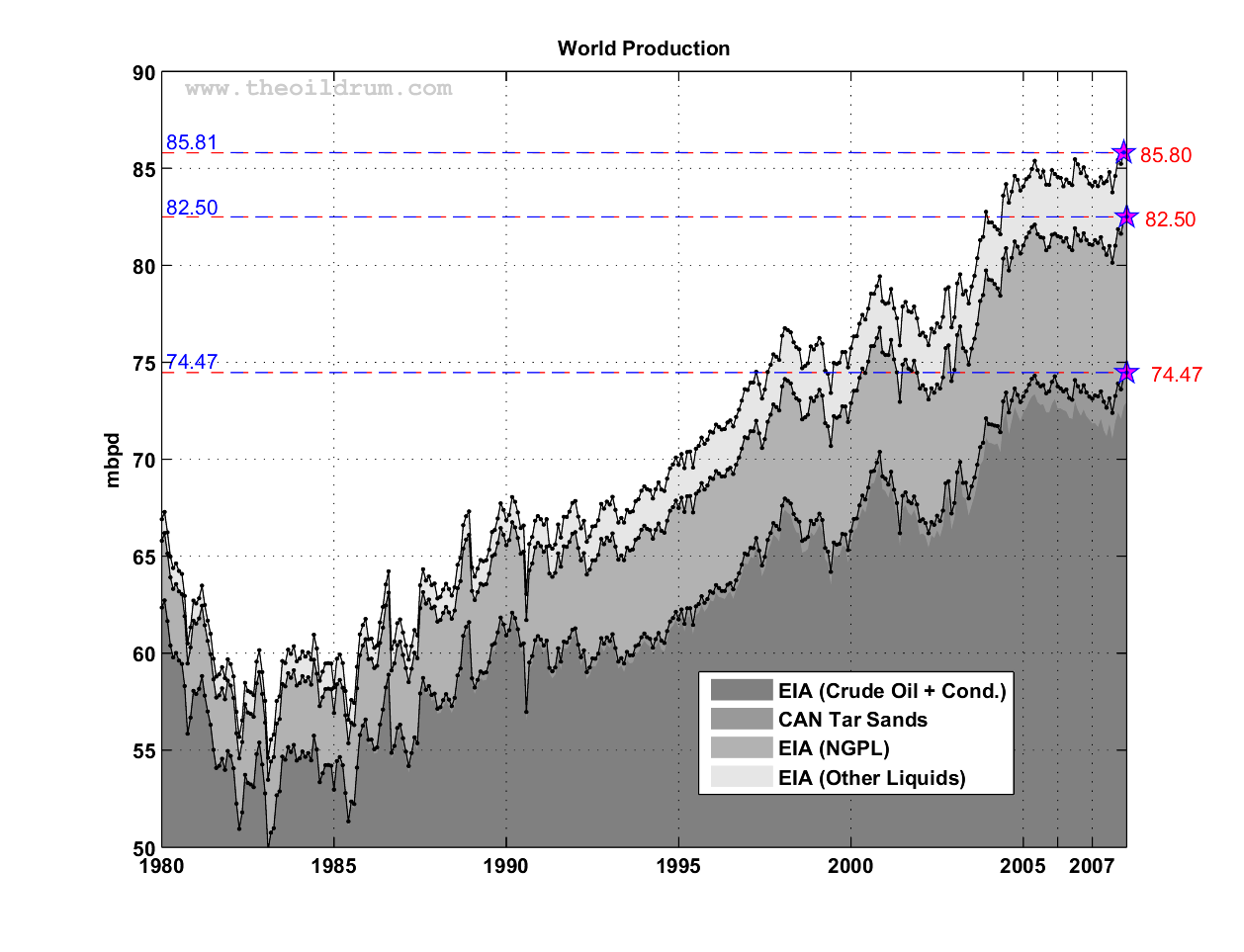

Just as a comparison, wikipedia suggests that "global supply" from 2005-2007 was closer to 85 mbpd, but this includes biofuels, non-crude sources of petroleum, and the use of strategic oil reserves. For the purposes of this bet, we need to measure solely the global production of crude oil (plus condensates) (e.g. as listed by the EIA). Similarly, the Oil Drum reports the monthly peak of crude oil + condensate in May 2005 at 74.15 mbpd; crude oil + natural gas also May 2005 at 82.08 mbpd, while "all liquids" peaked in July 2006 at 85.47 mbpd.

The number we're interested in is the average annual production of crude oil plus condensate, which had a peak so far (through Feb 2007) in 2005 at 73.65 mbpd.

Graphs from LifeAfterTheOilCrash.net.

Update, 4/16/2008. Here's what I get for not doing my research before picking a number for this bet. On 4/11/2008, TheOilDrum.com reported that the January 2008 crude oil (plus condensate) production broke the May 2005 record! Oil production in Jan 2008 was 74.466 mbpd. Just one month, and not yet at 75 mbpd, but still ... that's getting a little close for comfort.

More graphs from TheOilDrum.com (click for full size):

Update, 5/12/2011: amusing cartoon explanation of Peak Oil.

| webmaster@geddis.org | For encrypted email, use my PGP Public Key. | Last updated 06/09/17 |